Ethereum (ETH) surged another 8% overnight, while Bitcoin (BTC), despite breaking through $120,000, only saw a 1.6% increase during the same period.

Part of ETH's growth stems from the passage of the GENIUS Act, a long-awaited legislation providing regulatory clarity for stablecoins primarily built on Ethereum. This rally is further fueled by new institutional accumulation, as ETH strengthens its position as Web3's utility layer.

Meanwhile, Bitcoin appears to have paused its upward momentum after recently setting new local highs. But the real surprise lies beneath the surface - Bitcoin Hyper (HYPER), currently the fastest Bitcoin Layer-2 solution, has raised over $300,000 in just 48 hours, bringing its total funding to $3.31 million.

Early investors seem to be positioning themselves not just in Bitcoin the asset, but in Bitcoin's future - one that looks more dynamic, functional, and programmable.

The HYPER token currently trades at $0.0123, with less than 14 hours remaining before the next presale price increase.

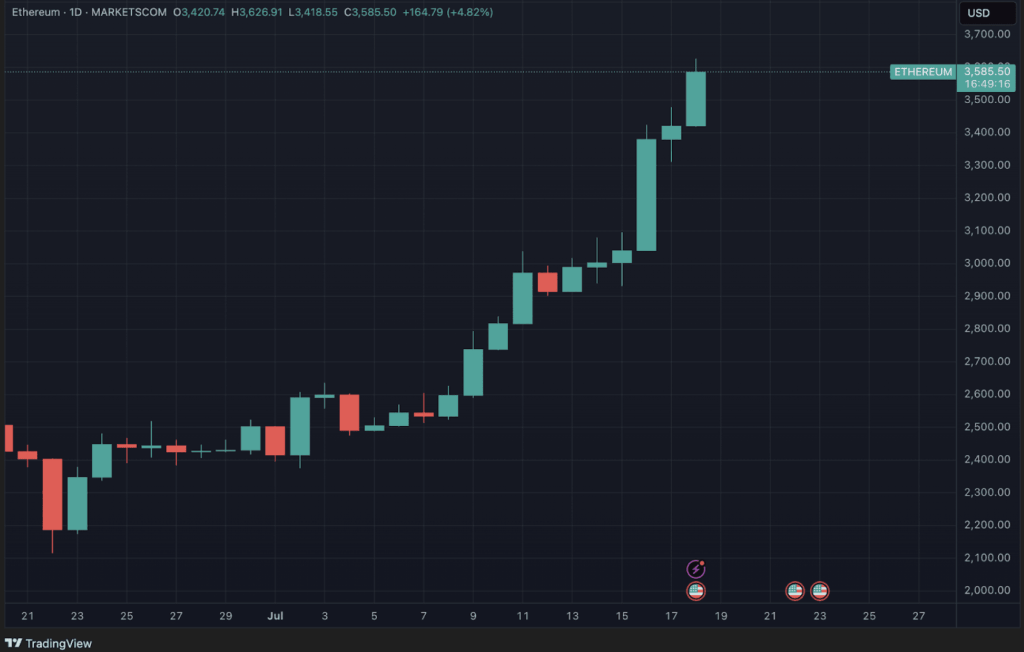

Ethereum (ETH) continues its upward trajectory this week, hitting a local high of $3,626 on Friday before settling around $3,585.50 at time of writing. This rally stems from renewed institutional interest and growing political tailwinds, making it one to watch! Ethereum charges ahead as Bitcoin slows!

The GENIUS Act, a landmark bill passed by the Senate in June, received official House approval on Thursday, paving the way for federal stablecoin regulation.

This legislation is designed to clarify rules for stablecoins and tokenized assets, representing a major victory for Ethereum's core infrastructure.

With most stablecoins, DeFi protocols, and token platforms built on Ethereum, markets interpret this development as bullish for further institutional adoption.

Ethereum ETFs also saw renewed inflows this week - over $726 million - reinforcing the narrative that institutions are doubling down on ETH exposure ahead of clearer regulations.

In contrast, Bitcoin (BTC) lost momentum after touching $122,838 earlier, dipping to $116,000 early in the week before stabilizing at current levels.

Bitcoin's price appears to be consolidating, lacking strong narratives or upgrade cycles to propel it forward as traders seek growth elsewhere.

While BTC trading remains flat, conviction in its long-term potential hasn't disappeared - it's simply shifting to alternative bets.

One of this week's most talked-about developments is the rapid growth of Bitcoin Hyper, a high-speed Layer-2 built on Solana Virtual Machine (SVM). Its presale has skyrocketed to unbelievable levels despite launching barely over a month ago.

Clearly, even as Bitcoin's price stalls, believers in its future continue supporting Bitcoin's transition from payment layer to programmable network.

As mentioned, Bitcoin Hyper is built on SVM and operates as follows: BTC gets locked on-chain using permissionless, trustless bridges, with wrapped versions created on Bitcoin Hyper Layer-2 - making it one of 4 coins potentially poised for 1000x gains.

These can then operate on a high-speed network combining Solana's execution speed with Bitcoin's value base, without compromising either.

Instead of sitting idle in cold storage or existing ETFs, BTC can move freely through previously inaccessible applications - near-zero-fee trading, DeFi protocols with native BTC liquidity, or NFT drops settled in Bitcoin.

While all this happens on Layer-2, the actual Bitcoin remains secured by Bitcoin's own consensus. The bridge uses Zero-Knowledge Proofs, allowing users to move Bitcoin in/out without intermediaries while maintaining full trust in the original network.

For users wanting to withdraw BTC, the process is equally seamless - simply burn the wrapped Layer-2 version to release native Bitcoin from the bridge.

Bitcoin Hyper is built for rapid development, with live SDK/APIs and full Rust support - Solana and Web3's native language.

Developers can start immediately without learning obscure frameworks or custom languages. Unlike past efforts like Stacks or Rootstock, Bitcoin Hyper introduces no additional downtime or fragmentation - it preserves BTC's base while unlocking true programmability.

While Ethereum rallies on utility and clarity, Bitcoin drifts directionless - which is exactly why capital is flowing toward what Bitcoin could become. Bitcoin Hyper is being funded not for what BTC is today, but for what it could be tomorrow.

If you see this same emerging trend - where Bitcoin gains speed, programmability, and more real-world use cases - now is the time to act.

Once again, Bitcoin Hyper's presale has raised over $3.31 million, with 191 million HYPER tokens staked on its native protocol offering 274% dynamic APY - showing early believers are truly long-term committed.

Visit Bitcoin Hyper's website to secure HYPER tokens before the next price increase. Purchase using SOL, ETH, USDT, BNB, or even credit cards.

For smoother experience, consider using Best Wallet - HYPER is already listed under Coming Soon tokens for easy tracking, management, and claiming.

Join the conversation on Telegram and X

Visit Bitcoin Hyper Token